CFO Suite: an exciting Fintech vertical, where great companies are coming to maturity

We see plenty of opportunities in the Fintech space

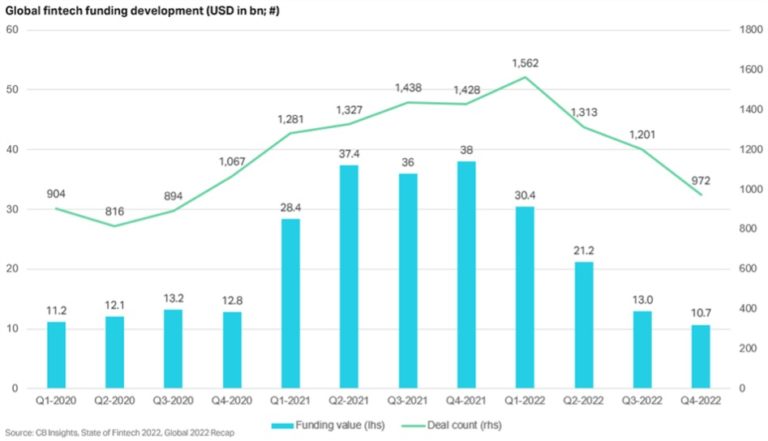

2022 was a difficult year for the tech sector in general, and the Fintech vertical in particular.

A historically low level of consumer confidence and record high inflation put pressure on consumers’ personal finances and savings plans. Fast rising interest rates created pressures for asset heavy business models (e.g., in digital lending). Valuation multiples of public companies saw a substantial drop across various geographies. The venture capital funding environment, especially in late stages, slowed down significantly compared to 2021 levels.

Figure 1: Global Fintech funding evolution over time

Yet, despite these headwinds, we remain very bullish on the Fintech sector. We believe the financial industry disruption which started in the past few years is deemed to continue at pace. As a matter of fact, we keep seeing exciting companies with novel propositions, business models, go-to-market strategies, and especially high-caliber teams, maturing into growth-stages.

In this context, we recently refreshed our Fintech thesis, to identify the areas where we want to be particularly active in the next months. The ‘CFO Suite’ space clearly emerged as an interesting area for a deep dive. Plenty of exciting companies are reaching growth stage maturity and appear on the cusp of affirming themselves as industry leaders.

CFO tooling for SMEs – a large and underserved market

Small and medium enterprises are the backbone of the European economy. As reported by Eurostat, in 2021, the 23m active SMEs (defined as enterprises with less than 250 employees and €50m of turnover) in EU-27 accounted for 52% of the value creation in our continent (half of which focused on knowledge and / or tech intensive industries), and employed 83m people.

As true for the whole European economy, SMEs are increasingly suffering from the recent macro slowdown. In fact, OECD research shows that, in period of macro downturns, SMEs are particularly subject to financial distress. Their balance sheets being usually inferior in size and quality to their enterprise counterparts, demand slumps are typically followed by increase in payment delays, working capital depletion, and ultimately increases in insolvencies and bankruptcies.

The response of SMEs to these pressures comprise cost-cutting measures aimed to increase profitability. Automation is a significant driver of cost-cutting: it either reduces the number of FTEs required to support a given process, and / or it reduces the need to scale FTEs as the organization grows and processes increase in complexity.

Incumbent solutions for financial process automation hardly fit SME needs, and rather fall into one of two archetypes: 1. Basic solutions (e.g., the good, old, clunky XLS sheets) which still require significant manual intervention and are increasingly unadapt to serve modern and complex SMEs; 2. Legacy solutions designed for enterprises, which typically are excessively complex, costly (e.g., requiring some investments in infrastructure / integrations), unscalable (as they tend to create IT legacy infrastructure which can’t hardly adapt to the evolving SME needs).

Opposed to that, neo-solutions can benefit from having a backless tech infrastructure, which makes them much more agile (as they are not constrained by legacy IT systems), flexible (thanks to a cloud-based infrastructure and API integrations), and cost-effective (with service-based pricing models). Furthermore, they are building solutions which are low-code / no-code and enable SMEs to get onboarded with a very limited need for specialized IT FTEs.

Different entry points towards a common goal

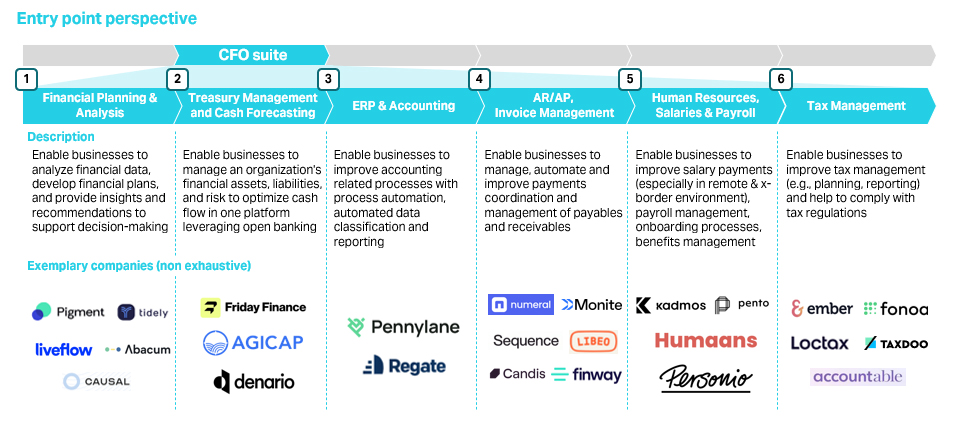

Finding the right entry point to automate the diverse set of financial processes is a delicate decision, and there is no definitive right answer.

On one end, we are observing a transformation of the CFO function towards a more strategic role, which represents a strong tailwind for strategic tooling like FP&A. On the other, we see SMEs operating in very traditional and non-digitized segments, embarking on a journey of digital tooling adoption – for them, there is an expectation for tools digitizing more ‘transactional’ processes (e.g., invoice automation and management) to be particularly relevant in the immediate future.

In this context, it is not a surprise that exciting companies are entering the ‘CFO Suite’ space from different angles, which are summarized in Figure 2.

Figure 2: ‘CFO Suite’ entry points

Note: exemplary companies have been slotted into verticals based on what we see being their main focus, while the scope of their solutions might well span beyond one vertical (and actually it often does already).

Independent from the entry point, we believe that the Finance tech stack will eventually see a re-bundling. Hence, as we elaborate in the next paragraph, we believe that the ability of expanding the product suite beyond a given vertical, will be a critical asset for companies who want to scale in the space.

Success is driven by a compositive of tech and distribution capabilities

As we just established that the entry point to the ‘CFO Suite’ space can’t be the key determinant of success, we see other factors driving that – the most relevant ones include:

- Constant product development towards a financial tools re-bundling. As the reference market for ‘CFO suite’ solutions taken singularly (e.g., FP&A only, or treasury only) is large but not huge, and given that this market does not have the ‘winner takes most’ traits, we believe that successful companies will need to expand their offering beyond one vertical and possibly re-bundle financial services under their umbrella. Building extensive product solutions would be advantageous for tech vendors (as they could increase ARPU and stickiness), but also arguably represent a strong ‘all-in-one’ proposition for SMEs which are unlikely to interact with multiple vendors to build a ‘best-of-breed’ tech infrastructure.

- Solutions balancing deep service of customer needs and scalability. Companies in the space are dealing with the conundrum of developing solutions which deeply address their client needs (e.g., in the case of FP&A, this might entail some handholding of clients after-sale, incl. model customization) while ensuring fast solution deployment and ultimately scalability. We believe successful companies need to maintain traction while increasing post-sale efficiency, via automation and effective low-code solutions which are extremely intuitive to customers.

- Leverage of data, and AI / ML to unlock additional monetization opportunities. Open banking and direct interaction with customers allow companies in the space to access valuable financial data, which should be used for data driven personalization, feeding back insights & analytics that SMEs hardly access today, and product development to unlock additional monetization potential as described above.

- Hybrid distribution approach, complementing outbound with smart strategies to generate inbound. Given the learnings from our portfolio, we strongly believe that – even in the B2SMB space – companies should try to adopt scalable product-led growth methods, and rather avoid relying on a large salesforce for their success. At the same time, we recognize that establishing an efficient acquisition engine for financial productivity tools is a particularly hard nut to crack – selling to CFOs is hard, and some ‘traditional selling’ might be always required. Yet, select companies provide an interesting case study on smart acquisition strategies (see deep dive below).

Case-study: Xero playbook to efficient acquisition

Selling to CFOs is hard. They are sophisticated buyers, with a deep understanding of their needs and (by definition!) high price sensitivity. They need to be captured at the moment of need and might well require some convincing before buying into a new solution.

Due to that, it might feel natural to think that the only option for a solution targeting CFOs is to establish a skilled salesforce. Yet, companies like Xero offer an alternative perspective – it might well be possible to sell productivity tools for the financial function efficiently at scale and contain outbound efforts to the bare minimum.

The strategy deployed by Xero is built around two levers:

- Leverage partners. Xero realized that the best distribution channel for them were companies’ external accountants and consultants (which in 2016 generated as much as 90% of the Xero subscriptions in Australia and New Zealand). Yet, Xero also realized that it is hard to make accountants SW resellers. Hence, they employed a strategy to make accountants endorsers of the product, by making them appreciate how cloud accounting could benefit them and their clients. This required Xero to recruit accountants to quarterly events, where they could be introduced to the technology and its value – it continued with ongoing education, including account managers dedicated to support partners.

- Leverage content & community marketing. Beyond SEM / SEO / outbound, content marketing (including guides for SMEs, guides for accountants, podcasts) has been a staple of Xero’s strategy. Furthermore, Xero built a strong community forum, allowing accountants and customers to exchange disintermediated ideas and best practices on the company products.

The ‘Xero playbook’ has not worked for Xero exclusively. Some darlings of the ’CFO Suite’ space have scaled very fast since inception in 2020, and attracted significant investment by blue-chip investors, by deploying a very similar acquisition model.

Conclusions

At Burda Principal Investments we provide long term growth capital to fast growing digital technology companies, focusing on platform, marketplace, and software models. Fintech is a vertical where we remain active and bullish. As we are looking to expand our Fintech exposure, we are constantly performing research on the latest sector trends.

Having recently refreshed our thinking on the ‘CFO Suite of the Future’, a segment which we are very excited about, we wanted to share our thoughts in this forum. We hope you enjoyed this read and – if you would like to discuss our thoughts or introduce your company – please reach out to us at investments@burda.com or by directly contacting the authors Francesco and Vincent.