Fintech in Indonesia: Rainbow After the Storm?

For several years, Indonesia’s startup scene has experienced robust inflows of investment funding from investors seeking to capitalize on the country’s promising growth prospects and demographics. Fintech has been a focal sector, garnering a significant portion of this funding. However, 2023 marked a challenging year for startups in Indonesia and Southeast Asia as a whole. Fundraising became increasingly difficult due to higher interest rates, affecting almost all VC sectors, but particularly impacting the fintech sector where an extremely low cost of capital had become the norm. Founders who had invested heavily in growth were forced to rethink their strategy and many were compelled to adopt more prudent and strategic approaches to ensure the long-term viability and resilience of their startups amidst uncertain market conditions.

The evolution of Fintech in Indonesia

Indonesia’s fintech sector has undergone significant growth and evolution, initially driven by advancements in online payments, spurred by the emergence of digital transaction and technology companies. As payments became more digitalised, this also heralded the rise of e-wallets to facilitate digitised cash transactions. Consequently, the payments sector accounted for the largest number of fintech unicorns in the space.

With more than half of Indonesia’s population classified as unbanked or underbanked, fintech lending platforms emerged to address this gap. Various lending offerings such as Buy-Now-Pay-Later (BNPL) schemes, Peer-to-Peer (P2P) lending, consumer loans, and Micro, Small, and Medium Enterprise (MSME) loans have already proliferated. Presently, many of these solutions and offerings have extended their reach to previously unexplored and untapped markets in tier 2 and 3 cities, while also catering to the needs of emerging startups and small businesses. This shift underscores the adaptability and extensive innovations in Indonesia’s fintech sector.

As the underlying fintech infrastructure continues to mature and regulatory oversight strengthens, buoyed by an increasingly digitally savvy populace, the demand for digital banking solutions, wealth management, and advancements in the Insurtech sector has surged. Indonesia, with its predominantly young population (median age of 31.2 years and 68% of the working population aged 15–64), stands at the forefront of this digital transformation.

A bright spot for Fintech in the region

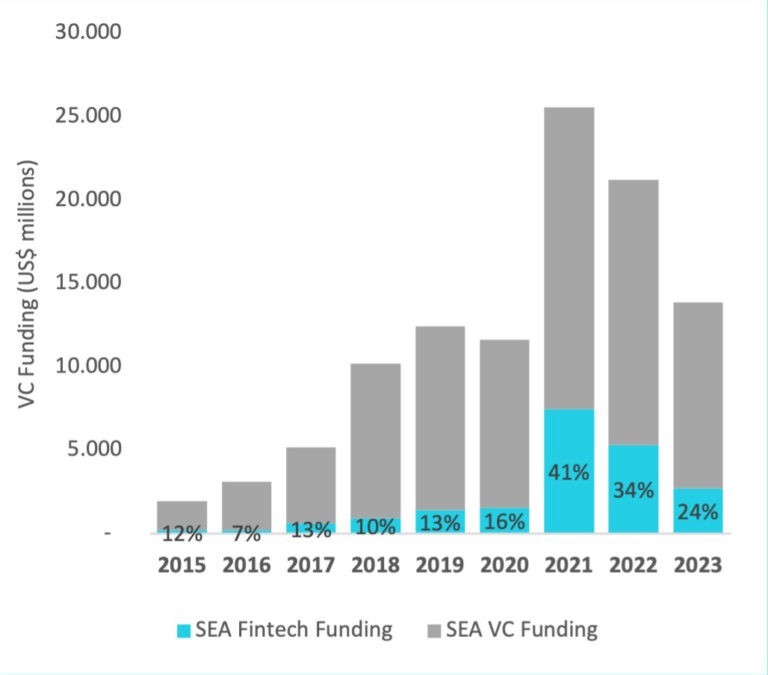

Chart 1 – Proportion of Fintech Funding in Southeast Asia

Source: Pitchbook, note that some transactions may not include or disclose deal amount.

Indonesia shines as a beacon for fintech in Southeast Asia, as illustrated by Chart 1, consistently securing the second spot in VC funding for fintech behind Singapore, a conduit for capital flows in SEA. While characteristics like a large population, favourable demographics and large unbanked/underbanked population are all well-known factors, BPI’s research has pinpointed several other reasons for this phenomenon:

1. A policy push towards a digital economy and pro-business, pro-investment policies. Throughout the tenure of the outgoing Joko Widodo (Jokowi) administration, the government, in collaboration with key entities such as the Ministry of Finance, Bank Indonesia (BI), the Financial Services Authority (OJK), have come together to foster a conducive environment for the digital economy. Some of the key initiatives include:

- The development of digital infrastructure such as improving internet connectivity and expanding mobile network coverage across the archipelago. This has provided a solid foundation for digital startups to operate and grow.Simplifying and streamlining the process of registering and licensing businesses, including digital startups.

- Creating regulatory frameworks that promote financial inclusion while safeguarding consumer interests. One key example is OJK’s Regulatory Sandbox which provides a conducive environment for fintech startups to develop and test their products and services under relaxed regulatory conditions. By participating in the sandbox, startups can demonstrate viability of their solutions, gain valuable feedback, and eventually obtain necessary licenses for full-scale operations.

- The promotion of the adoption of digital payments to reduce reliance on cash transactions. Initiatives such as the National Non-Cash Movement (GNNT) have encouraged the use of electronic payments, benefiting digital payment startups and e-commerce platforms.

- The creation of a supportive regulatory environment for digital startups, including initiatives to facilitate crowdfunding, protect intellectual property rights, and encourage investment in the tech sector.

2. Unique talent pool of founders that possess deep cultural and linguistic understanding of the market, coupled with global exposure and mobility. Indonesia talent often possesses global exposure and mobility, with many individuals having studied or worked abroad in leading tech hubs such as Silicon Valley, Singapore, or Beijing. An internal BPI analysis of fintech companies headquartered in Indonesia1 shows that a large majority of startups in the list have at least one founder with an international background. Most founding teams consist of two to three founders with complementary skillsets, with 31% coming from global consulting/banking backgrounds and 28% with global big tech experience. We believe this unique combination enables startups to tailor their products to local preferences while drawing on international best practices and experiences, enhancing the competitiveness of the startup ecosystem. Startups with teams that blend cultural insights with global perspectives are well-positioned to navigate regulatory challenges, build strong customer relationships and facilitates cross-border collaborations and investments.

3. Increasing investor focus on social enterprises and impact investing. Fintech platforms in Indonesia bring multifaceted impacts on society, including expanding access to financial services for marginalised communities, empowering female entrepreneurs, promoting financial education and literacy, and facilitating impact investing and social enterprise support. This enables impact-driven institutions to invest in businesses that generate positive social impact alongside financial returns, driving the positive uptake in fintech investments.

Thus, we see attractive and significant opportunities in the fintech sector in Indonesia. Furthermore, successful startups in this area could have a significant positive social impact in terms of increasing financial inclusion. The challenge, however, is to overcoming existing barriers to unlock the full market potential.

Recent challenges faced by the industry

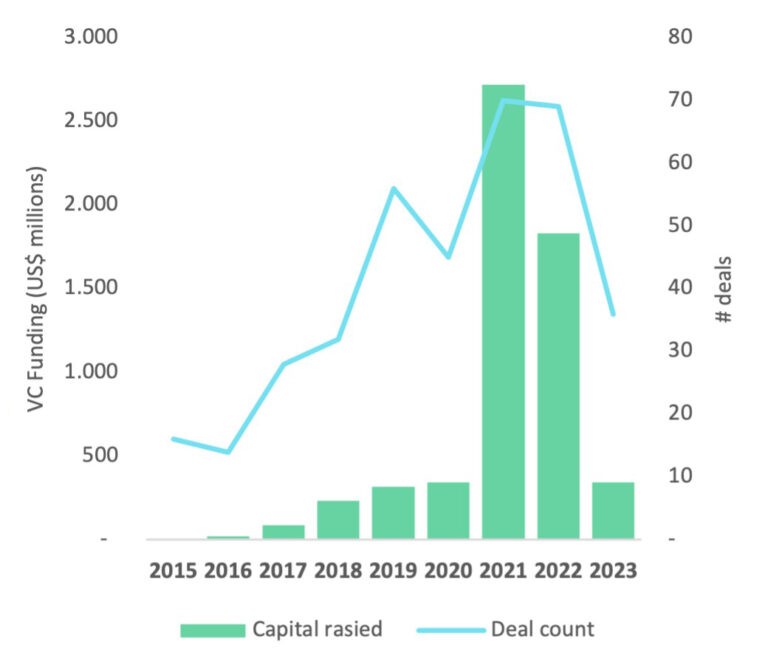

Chart 2 – Fintech funding in Indonesia

Chart 3 – Proportion of VC funding in Indonesia

Source: Pitchbook, note that some transactions may not include or disclose deal amount

Charts 2 and 3 illustrate the decrease in funding within the Indonesia fintech sector, not just in terms of absolute funding, but also as a share of total investment in the archipelago. Several challenges confront fintech companies, including:

1. Rising interest rates: Increasing interest rates elevate the cost of funds, squeezing margins for numerous lending startups and rendering their unit economics unsustainable.

2. Intensifying competition: Fierce competition within the fintech space arises not only from pure fintech firms but also from established tech companies venturing into fintech and traditional banks diversifying into fintech solutions.

3. Profitability concerns: Many startups have not been able to deliver positive unit economics at scale. Coupled with the funding winter, numerous startups have also been downsizing, jeopardizing growth.

4. Lack of successful exits: Despite the vibrant and growing fintech ecosystem in Indonesia, characterized by numerous startups and significant investment inflows, there are few prominent cases of successful exits for fintech companies.

5. Disruptive incidents: Recent incidents, such as well-funded companies facing liquidity challenges and unethical behavior among management, have raised concerns. This could stem from a lack of transparency and an effective regulatory environment, deterring certain investors.

Internally, BPI has identified several potential factors contributing to the loss of investor confidence:

1. Pathway to profitability – many fintech startups have achieved significant operational scale but have yet to demonstrate profitability. This raises concerns about the long-term sustainability of these businesses. Can these startups ultimately achieve growth with sustainable economics?

2. Market size – one critical consideration for fintech startups in Indonesia is the potential for regional expansion versus the size of the domestic market. With Southeast Asia comprising diverse countries with distinct cultures, preferences and regulations, investors and stakeholders are evaluating whether fintech platforms can effectively scale beyond Indonesia’s borders, adeptly navigating these differences, or if the market within Indonesia itself offers sufficient growth opportunities. Ultimately, the key question remains: Can fintech platforms in Indonesia regionalize or is the country’s market size substantial enough on its own?

3. Domestic market outreach – A significant opportunity for fintech companies in Indonesia lies in addressing the financial needs of the underbanked and unserved populations, particularly those residing in the tier two and tier three cities. With many of the fintech startups still serving mainly consumers in major cities, investors are questioning if these startups can effectively reach out to the underbanked, underserved outside Jakarta and tier one cities.

Zooming out to FinTech in the region

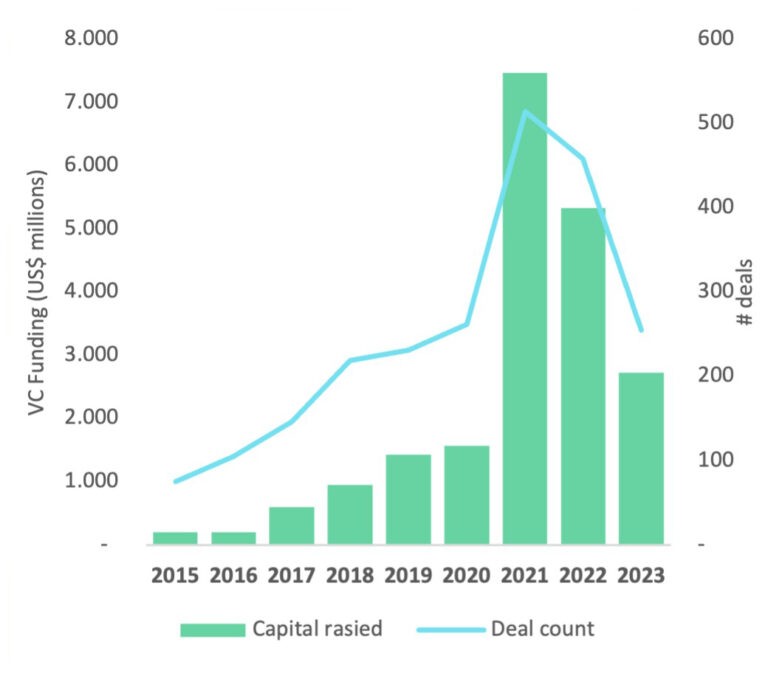

To provide a comprehensive view and insightful comparison, we also looked at the fintech space in Southeast Asia. Regarding funding dynamics, we note parallel trends where funding reached its peak in 2021 and a decrease in proportion of capital invested into Fintech companies in the last 12-24 months.

Chart 4 – Fintech Funding in Southeast Asia

Chart 5 – Proportion of VC Funding in Southeast Asia

Source: Pitchbook, note that some transactions may not include or disclose deal amount

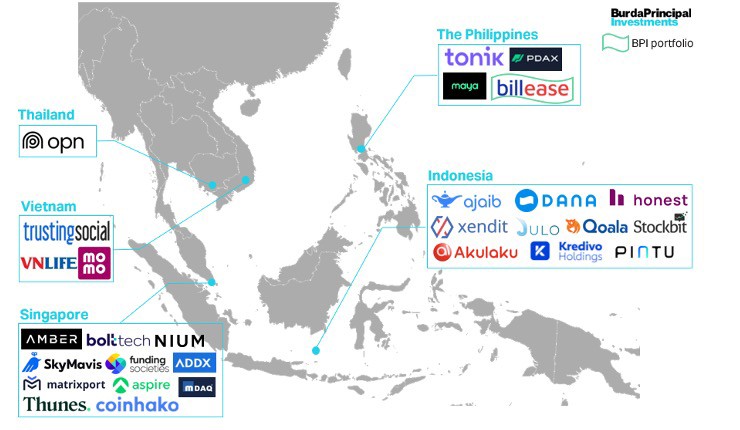

In the realm of start-up unicorns, the fintech sector undeniably boasts one of the highest numbers of these entities. Our analysis shows that of the fintech companies featured below in the region, most either operate within the payments/e-wallets and/or lending space, focused on providing financial inclusion for the underserved, with the exception of a handful in the wealth technology & management and digital banking platform sectors.

Chart 6 – VC-backed Fintech Unicorns & Soonicorns in Southeast Asia

The data presented reflects the information available as of April 2024. Valuations for private companies are based on the most recent valuation data obtained from Pitchbook and public news sources..

What’s keeping us excited

Following the conclusion of elections in Indonesia, the incoming leadership has pledged to continue Jokowi’s legacy of investing in Indonesia’s digital economy and to retain business-friendly policies2 that have been instrumental in attracting foreign investments into Indonesia. We remain optimistic about the prospects of the fintech sector in Indonesia, but competition will be tough and only the fittest will survive in the current macroeconomic environment. BPI analysis suggests that the number of active fintech companies in Indonesia fell by 40% between 2021 and 2023. We believe founders and startups emerging from this difficult period will emerge stronger and more resilient, learning and pivoting from a grow-at-all-cost approach to a value-based growth approach.

Internally, our discussions focus on several open questions. What will differentiate each fintech company from their competitors? What will be the long-term differentiators? What business models will be best suited to reach the majority of the population? Here, we have identified several key qualities we will be looking out for in founders in the space:

- Comprehensive understanding of regulatory frameworks in Indonesia and other Southeast Asian markets, along with swift responsiveness.

- The ability to attract and retain specialized talents in the fintech space (risk management, artificial intelligence, and machine learning).

- Skillful navigation between achieving positive unit economics and sustaining growth.

- Strategic foresight and adaptability to the evolving landscape of Southeast Asia, characterized by long term planning.

1The list includes the fintech unicorns in Indonesia and startups that has raised substantial external funding from institutional investors.

2 Reuters, ASEAN briefing, and various public news sources.

Conclusions

Despite the recent storm, we see a rainbow around the corner

From a growth VC perspective, we hold an optimistic outlook on the emergence of both local and regional frontrunners originating from Indonesia, recognizing its expansive market potential for accommodating multiple players. We are in particular looking for an ascendant player which can grow into a dominant player in Indonesia, with sights set on a regional playbook over the longer term. Companies that are strong in Indonesia are inevitably familiar with navigating the complexities of fragmented domestic markets. This puts them in a good position to drive innovation, improve product quality and lower prices, ultimately making them more accessible to a regional audience.

Finally, we will be keeping a look out for untapped potential in less prominent areas, with the credit card and cross-border payment sectors being the prime examples. Additionally, we are also excited about fintech companies who can leverage on AI to improve efficiencies and unlock more value.

At BPI, we pride our ability to help our portfolio companies scale globally and hence are actively looking for future fintech unicorns. We are always open to discussions with founders and investors who are as excited as we are about the prospects in this space – or who can upend and challenge our thinking in a refreshing new manner. Please get in touch with Neil and Elis.