Ready to revolutionize the food system and solve multiple problems at once?

New food sources are disrupting the traditional food industry providing the tasty, sustainable alternatives we have been waiting for

The global food system is facing unprecedented challenges, from climate change and resource scarcity to increasing demand for more sustainable and nutritious food. With a growing global population set to reach 10 billion people mid-century and changing dietary preferences depending on the region, the food industry is being forced to evolve and adopt innovative solutions to meet these challenges. This has given rise to the emerging FoodTech sector, which is poised to disrupt the traditional food industry.

We see change being triggered by

1) the need to feed the world with 8 billion people today, soon to be 10 billion,

2) climate change affecting arable land and harvests around the globe,

3) supply concentration sparking dependencies and food shortages.

At Burda Principal Investments, we understand FoodTech as encompassing a broad range of technologies and innovations that are transforming the way we produce, distribute, and consume food. This includes using ingredients and technologies in an innovative way, ranging from plant-based proteins to fermentation-based and cell-cultivated foods to deliver a sustainable, reliable, and alternative source of calories for today’s and future generations.

1) Status quo of the global food system

Today’s food system is highly connected, interdependent, and based on decades of established ways of working. With a continuously increasing and ever more demanding population, our current system will struggle to deliver high-quality and reliable production of protein needed. This is not lastly due to the limited arable land available.

Increasing climatic events are proof of climate change affecting global food supply. These high-impact events, along with real-time images, spark consumers’ action to reduce their carbon footprint. One way to achieve this, is to change the way we address consumption, as the food sector alone accounts for 26% of global greenhouse gas emissions, according to Our World in Data.

Figure 1 – Our World in Data, Global greenhouse gas emissions from food production (Link)

Supply concentrations show the vulnerability of the food segment, with an increasing number of disruptions triggered by climate events, supply chain bottlenecks, or others. It was made clear to the world that there are only six breadbaskets in existence that together supply roughly 60-70% of global agricultural commodities. For example, Ukraine and Russia are big players in world food production, representing 53% of global trade in sunflower oil and seeds and 27% in wheat, according to the United Nations.

Another impactful topic to be addressed in the status quo of our food system is food waste: as, currently, 30% of our food goes to waste.

2. What change in the food sector looks like

One of the biggest drivers of change in the FoodTech sector is the growing demand for sustainable, healthy, and nutritious food. Consumers are becoming increasingly conscious of the environmental impact of their food choices and are looking for more sustainable options. This has given rise to a host of startups that are developing innovative solutions to reduce the carbon footprint of food production and distribution while guaranteeing a reliable and decentralized food supply through alternative protein sources.

To generate mass-market adoption and trigger a repeat purchase behavior of consumers, alternative food products need to first and foremost resemble existing products in taste and texture, seek price parity, show a positive effect on health and nutrition, have a positive impact on the environment, and increase animal welfare.

Figure 2 – Consumer adoption pyramid for alternative proteins, own graphic

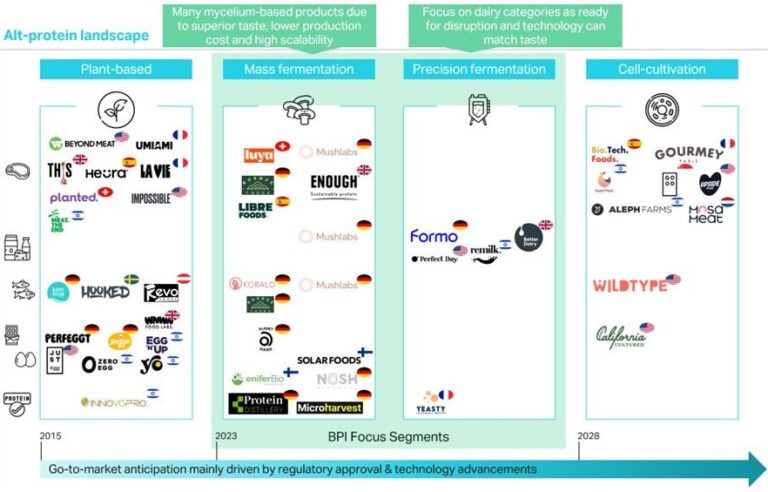

We think about the alternative protein space in three sub-segments based on the underlying technology: plant-based, fermentation-based, and cell-cultivated foods. Additionally, we look at the category being disrupted: ranging from meat, dairy, fish, egg, and chocolate, to broadly applicable proteins. We then also classify startups along these two axes. A landscape of relevant startups can be found in Figure 3, which is by no means exhaustive (Please reach out if you see a company missing and would like it to be added!)

Figure 3 – Alternative protein sector landscape, own graphic

3. Going forward: Trends we are focused on at BPI and what gets us excited

Venture Capital investors can play a critical role in shaping the future of the FoodTech industry. According to Pitchbook, annual deal activity in the FoodTech space totaled $20.2 billion across 1,578 deals in 2022. Deal values fell a whopping 56.5% YoY—following a historic investment year in 2021. Despite this decline, 2022 values fell in line with five-year historical medians and the deal count was the second largest on record, which leads us to the conclusion that this industry is clearly suffering the same systemic challenges as other tech industries.

At BPI, we look for de-risked, scalable opportunities in the alternative food space providing a double-bottom line. This includes positive financial and sustainability returns, driven by an experienced executive team looking to build a global leader in the alternative protein space.

We also look for initial market traction and proof of commercialization, the right level of innovation to garner mass-market adoption (i.e., fermentation technology), and a platform model that supports a broad product portfolio (new product introduction within a short timeframe).

With a B2B ingredients approach, we expect the greatest success in terms of business model scalability, as the focus lies on building the technology platform to deliver on quantity and quality for the customers. We believe in an external production set-up to work with an asset-light approach and to use the industries knowledge transfer in the technology scale-up phase of the company. Being able to decentralize production to supply products close to the customer, is another aspect we see great value in.

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationWatch our Investment Manager Luisa Frank talking all things FoodTech

Conclusions

In conclusion, the FoodTech sector is poised to disrupt the traditional food industry and offer more sustainable, reliable, and alternative sources of high-quality food. We as Venture Capital investors look to play a critical role in shaping the future of the FoodTech industry by supporting startups that are developing innovative solutions to address the challenges facing the food industry today and in the future.

If you would like to discuss any of the results of our survey, have a chat about the future FoodTech sector, or introduce your company then please reach out to us (investments@burda.com)!