Investors’ focus is shifting from infrastructure towards GenAI applications

In the last months we have followed and participated with excitement in the revolution driven by Generative Artificial Intelligence (GenAI) across consumer and business applications.

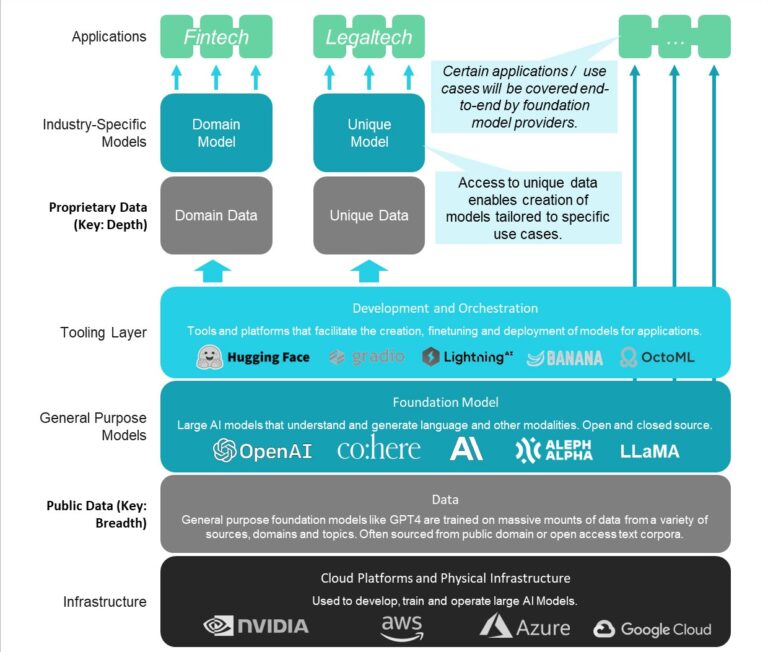

As part of our prior thought pieces on the topic (“The Third Wave”: Part I, II, III, and IV), we have outlined how investors’ attention to date mainly focused on the foundational layers of GenAI, such as the general-purpose models built by the likes of OpenAI, Anthropic, Mistral and Aleph Alpha (a BPI investment), as well as the infrastructural development and orchestration tools offered by platforms such as Hugging Face (see Exhibit 1 for an overview of the GenAI stack).

Exhibit 1: GenAI tech stack

Source: Burda Principal Investments analysis

In the period from 2018 to 2022, Pitchbook reported that only a scant 3% of worldwide GenAI funding went towards verticalized applications. However, this trend has started to turn swiftly. Pitchbook reported that in 2023 vertical applications are the subsegment in the GenAI space which saw the fastest YoY growth in terms of number of financing rounds. This is not surprising considering that LLMs accelerated the move towards enabling such applications – e.g., OpenAI’s Turbo (which makes building verticalized apps on top of their platform cheaper), Assistants APIs (which enable easier integrations with OpenAI’s model), GPT Store (which offers off the shelf GPTs that companies can use for fine-tuned models for verticalized apps).

We’ve previously illustrated our thesis on the application of GenAI within LegalTech, but another sector we see fast becoming ripe for disruption is Fintech. In this article we present an articulation of our perspectives on how financial technology stands to be transformed by GenAI, the potential hurdles, and how these challenges are being confronted head-on.

Fintech is a fertile ground for GenAI to start delivering its magic

Financial sector players have prolifically applied machine learning over the past years across a variety of use cases, from credit analytics, to underwriting, investing, etc. Being a knowledge-based function, we also see Finance as a strong candidate for the application of GenAI, more so today than in the past.

The Fintech space has witnessed a wave of innovation driven by open banking and embedded finance. These innovations resulted in a significant increase in the amount of data that large incumbents, and for the first time also neo players, can harness to generate value through GenAI.

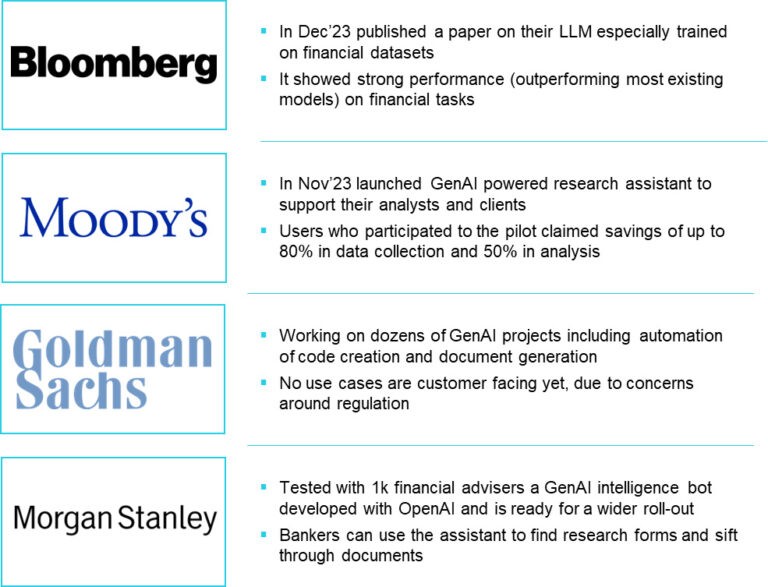

Given this environment, it is not surprising to see a multitude of players actively exploring this new technology. For instance, among incumbents, Bloomberg has developed an LLM specifically trained on financial datasets showing strong performance (see Exhibit 2 for further examples).

Exhibit 2: Examples of how FS incumbents are experimenting with GenAI

Source: Bloomberg (2023), Moody’s (2023), Reuters (2023)

This experimentation is not solely driven by top-down strategic decisions. It is also a response to the bottom-up pressures from employees. Having experienced the benefits of products like GPT as consumers, individuals are eagerly awaiting for similar tools to be made available for their professional work.

Overall, the combination of increased access to financial data, strategic priorities from financial institutions’ C-level, bottom-up pressures from these institutions’ employees, and external increasing demand from consumers, have created a fertile ground for GenAI to really start penetrating the Fintech sector.

However, the excitement around GenAI in the financial sector should not overshadow the challenges and risks associated with its implementation. GenAI is still a nascent technology that requires careful evaluation of its capabilities, limitations, and implications for different use cases and stakeholders.

In the financial sector in particular, GenAI adoption does not come without concerns and hurdles

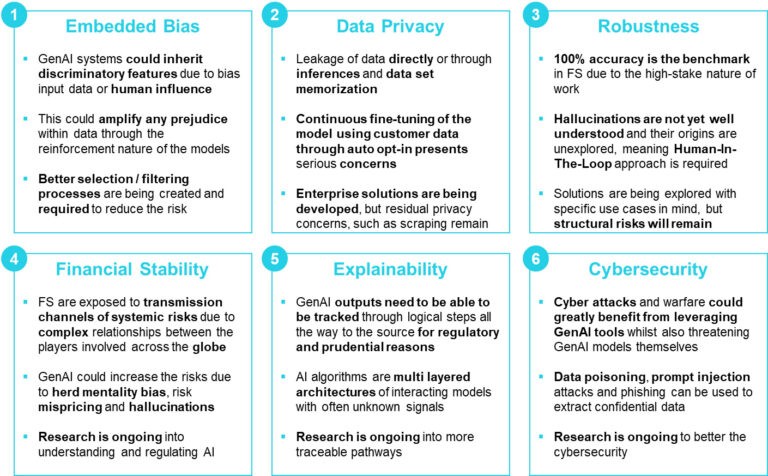

The finance industry is based on precision and trust, leaving no room for ambiguity. Ambiguity in the GenAI space finds the most prominent example in the phenomenon of hallucinations, which have not been fully addressed yet and somewhat structurally accompany a technology which is predictive in nature. As a result, applications of GenAI in the financial sector come with various warnings and considerations, as summarized by the IMF (see Exhibit 3).

Exhibit 3: Key considerations and concerns around use of GenAI in financial services (FS)

Source: International Monetary Fund (2023), BPI analysis

Despite these risks and limitations, GenAI players and their customers are actively working to address these concerns head-on. They are investing in research and development to improve robustness, mitigate embedded biases, strengthen data privacy protocols, and enhance explainability.

This work will not only be important, but required given emerging regulation. The EU AI Act which will be implemented from 2025 as the first legal framework on AI, will have impacts on financial institutions. It mandates that they adjust their AI models, especially for critical use cases like credit scoring, so that they are transparent, interpretable and use unbiased, premium-quality data. Non-compliance may result in financial penalties.

While we recognize the risks associated with GenAI in the financial sector and constraints coming from regulators, we do not see them as definitive obstacles that will hinder the inevitable permeation of GenAI innovation in finance. The potential benefits and opportunities that GenAI offers to the financial sector are too significant to be ignored. We remain optimistic about the gradual and thoughtful integration of GenAI innovations within the vertical.

We identified eight prominent GenAI applications in Fintech.

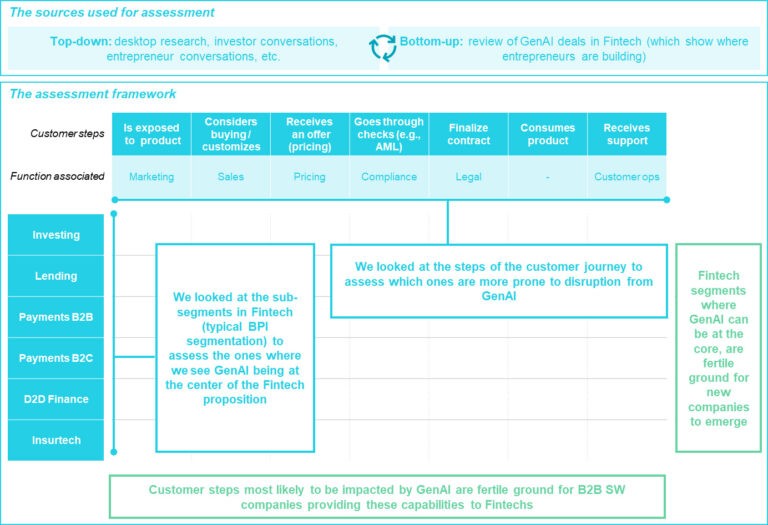

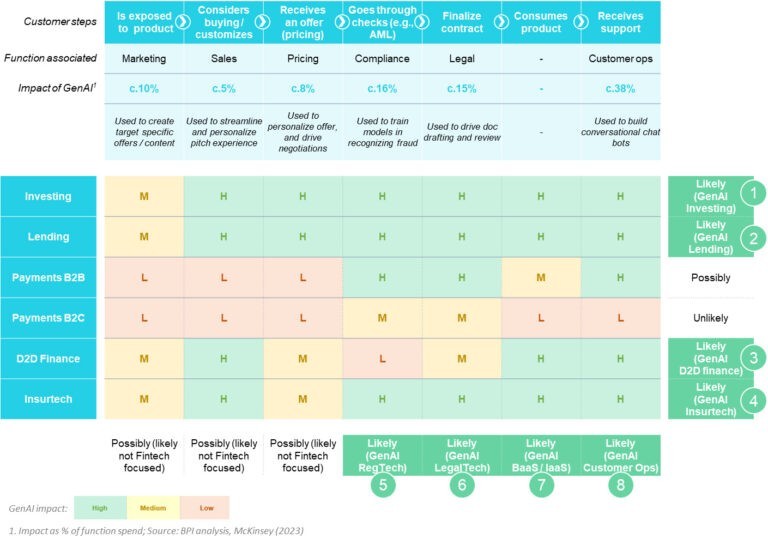

To understand the depth and breadth of GenAI’s impact on Fintech, we embarked on an analysis along two dimensions.

On one side we proceeded to analyse Fintech sub-segments, to identify those where GenAI has the potential to be at the core of the Fintech proposition. For example, InsurTech as a sector can greatly benefit from GenAI, given the opportunity to automate policy and claims management whilst making the entire experience more customized and conversational for the consumer.

On the other, we delved into the steps of the customer journey from consideration, to purchase, to eventual usage of Fintech products / services. By doing so, we identified which Fintech functions (Marketing & Sales, Pricing, Compliance, etc.) are most receptive to GenAI-driven transformation. In those areas, we see a fertile ground for Gen-AI SaaS companies to emerge to support Fintechs in delivering their services.

Exhibit 4: Methodology of our assessment on GenAI impact in the Fintech space

Source: BPI analysis

The results of our assessment are reported in the below table.

Exhibit 5: Overview of our assessment on GenAI impact in the Fintech space

Source: McKinsey Global Institute (2023), BPI Analysis

Based on this analysis, our view is that we will likely see GenAI transforming the Fintech landscape across 8 notable use cases. For the first four use cases (GenAI Investing, Lending, D2D Finance, Insurtech) we envision GenAI being used to build co-pilots helping customers to navigate and consume financial products. For the latter four use cases (GenAI RegTech, LegalTech, BaaS / IaaS, Customer Ops) we envision B2B SaaS businesses developing GenAI capabilities which FS businesses could embed in their processes.

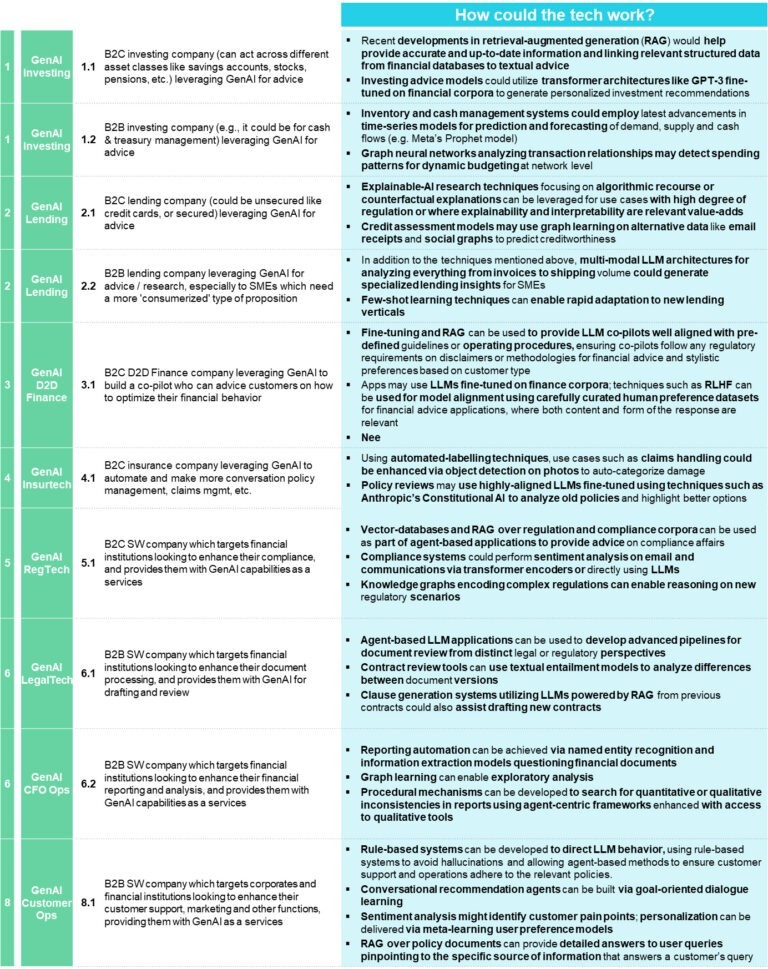

We collaborated with Creator Fund to further explain how we expect the technology to look like behind each of the use cases likely to emerge.

Exhibit 6: GenAI use cases in Fintech

Source: Creator Fund and BPI Analysis

To date, we have observed most GenAI companies operating in what we call “horizontal” applications (i.e. our use cases 5-8 in the framework). These companies serve as GenAI-enabled B2B SaaS providers, offering GenAI capabilities to financial institutions and Fintech companies as they cater to their customers.

Currently, we have yet to see many examples of Fintech scaleups that are placing GenAI at the forefront of their proposition (i.e. our use cases 1-4 in the framework). For instance, the concept of GenAI wealth managers, while exciting, still feels at least 1 year away from becoming a reality. This is not surprising, considering the novelty of the technology and the limitations and concerns we discussed earlier in this paper. While the idea of a GenAI wealth manager may take some time to materialize, we firmly believe that this will happen in the foreseeable future, and we look forward to seeing it happen at scale.

About the authors

Burda Principal Investments provides long term growth capital to fast growing digital technology companies, focusing on platform, marketplace, and software models.

Creator Fund backs AI and Deep Tech university founders solving the world’s toughest challenges, with a model conceived to find these founders first via a team of PhDs and other students embedded across campuses.

Our interest in the intersection of Fintech and GenAI is backed by a solid history of research and investments in the space. We wanted to share some of our thoughts in this article, which we hope you found interesting. If you’d like to discuss our ideas or introduce your company, please feel free to contact the authors from BPI: Francesco, Thomas, Vincent, and Creator Fund: Fernando. We thank Nikita Semenov for his contributions to this article.