Navigating the Digital Transformation in Hospitality

The transition from traditional on-premise providers to cloud-based platforms has sparked a wave of innovation and accessibility in the software industry over the past decade, revolutionizing how small and medium-sized businesses across various sectors access and utilize software solutions.

The realm of hotel software is no exception to this transformation. To provide a sense of the abundance of cloud solutions available today, the 2024 Hotel Tech Report identified over 2,500 technology vendors specializing in solutions for hotels along the different steps of the value chain (Figure 1).

In this article, we want to share our perspectives on the hotel and alternative lodging software industry. We will explain why we believe that now is a favorable time for businesses in this space and explore two sub-segments of this market that we are particularly enthusiastic about: all-in-one solutions for the long tail of establishments and second-generation property management systems (PMS) for medium and large hotels.

Figure 1 – Overview of the hotel tech stack by function

Source: Burda Principal Investments research and analysis, Hotel Tech Report

Note: The list of players provided is not comprehensive, and certain companies may operate in multiple segments. OTA stands for Online Travel Agency

This is an exciting time for companies building technology for hotels and alternative lodgings

It’s no secret that the COVID-19 pandemic dealt a significant blow to the travel industry. The challenges faced during and after this unprecedented event – including a sharp decline in travel volumes in 2020 and persistent labor shortages – have prompted hoteliers and vacation rental managers to seek innovative ways to improve the efficiency and competitiveness of their establishments.

Customers’ expectations have also quickly evolved in recent years, with a growing demand for digitized guest experiences such as in-room QR codes for service orders, communication with hotel staff through messaging apps, or self-check-in and check-out options.

In the broader context, a noteworthy long-term trend especially pertinent to smaller lodgings, involves the changing of the guard to a younger generation of managers. This new generation exhibits a greater familiarity and receptivity to integrating software solutions into their operations.

In response to these challenges and shifting demands, hoteliers have embraced technology as a catalyst for transformation. A global hotelier technology sentiment report published by stayntouch and NYU in 2022 found that over 80% of hoteliers either had already adopted at least one new technology during the pandemic or expressed their intention to do so going forward. A survey recently published by Duetto found 60%+ of respondents saying they had spent more in 2023 compared to 2022, and 70%+ predicting that hotel tech spend will continue to increase over the next three years.

The market for hotel tech has also been expanding more recently due to the blurring line between hotels and short-stay rentals. Property managers are increasingly looking to enhance their services, incorporating hotel-like branding and services, and often rely on hotel tech solutions to do so.

We believe that the combination of these factors sets the perfect grounds for strong founding teams looking to scale hotel and vacation rental software businesses today.

Consider SiteMinder, which commenced its journey in 2006 selling a channel manager and took roughly five years to surpass 4,000 properties. In contrast, Amenitiz made its debut in mid-2018 with a product that features a PMS, a component of the tech stack that’s more challenging to replace than any other because it controls the core of a hotel’s operations. By April 2022 – just four years later – Amenitiz had already successfully onboarded more than 4,000 establishments, up from 3,000 on the previous November.

All-in-one solutions have a good chance of capturing the long tail blue ocean

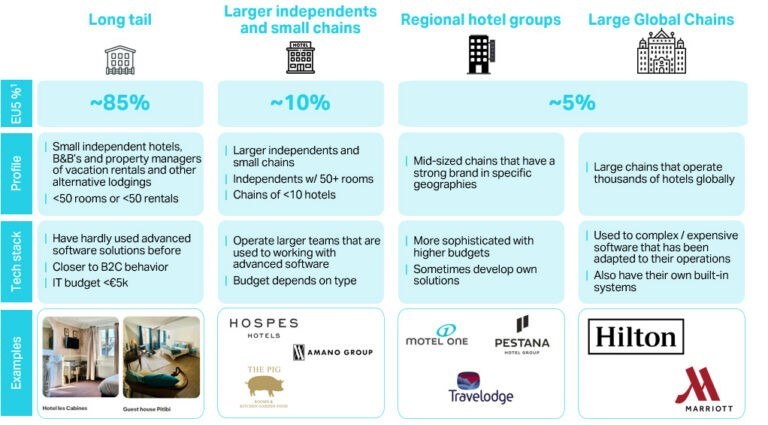

Software vendors segment the market into large global hotel chains, regional hotel groups, larger independent hotels & small hotel chains, and the long tail of smaller accommodations.

These four categories exhibit significant variations in terms of the number of rooms they manage and the size of their staff teams, as well as their financial resources and software requirements (Figure 2).

Figure 2 – Market segmentation of the hotel and alternative lodging space

Source: Eurostat, UK Office for National Statistics. 1) EU 5% of establishments in each category. Alternative lodging businesses are included within the long tail.

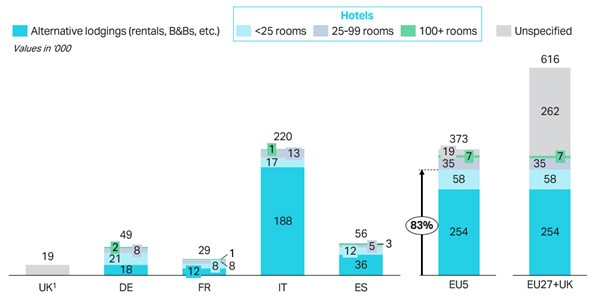

A closer examination of the European market reveals a few interesting facts. According to Eurostat and the UK Office for National Statistics, there are ~620k tourism establishments in Europe. ~400k of those are concentrated in the top five countries – Italy, Spain, France, Germany, and the UK – with Italy composing ~60% alone. A staggering ~85% of the market lies under the ‘long tail’ (Figure 3).

Figure 3 – Split in the number of hotels and alternative lodgings in Europe

Source: Eurostat, UK Office for National Statistics. 1) 2020 data for enterprises in the accommodation sector (note some might be chains so the number of hotels is likely to be larger).

However, this ‘long tail’ has historically received limited attention. This is partly because their IT investments have remained relatively modest, typically falling below €5,000 annually.

Moreover, reaching this segment presents a go-to-market challenge, as inbound has historically not worked well with hoteliers. The myriad of solutions available would require them to actively spend time researching and evaluating different options. Despite there being significant room for cost reduction and efficiency gains, most hoteliers run lean teams, leaving little room for focus outside of their day-to-day operations.

Due to these factors, investment in this segment until recently has been scarce, and as of now, the ‘long tail’ remains significantly underserved. Some establishments go as far as still using pen and paper. In many cases, they rely on a handful of outdated bootstrapped local solutions that serve a single or narrow set of functions and integrate poorly with adjacent solutions.

Despite the constraints posed by limited budgets and a challenging go-to-market motion, we see a significant opportunity for software businesses that target this long-neglected but substantial market segment due to the prevailing digitalization trends and the lackluster quality of existing solutions. The rapid growth of some of these solutions in recent times further validates this potential.

Case study: Strategies among companies focusing on the long tail

We have seen two approaches: all-in-one from the beginning and starting with a single point of entry. Our thesis is that a bundled offering will be essential for establishing a sizable and enduring presence in this market segment.

Platforms like Cloudbeds, Amenitiz, and Lodgify have embraced the “all-in-one” approach. They sell a PMS that is already integrated with the other key features that the manager of an establishment would usually need: channel manager, website builder, and booking engine. Over time, these companies have expanded their offerings to include other adjacent functionalities like revenue management, digital marketing, guest service automation, or payments.

In short, these companies offer hoteliers and managers an economical, seamlessly integrated, single-interface platform that covers all their basic needs, significantly reducing the range of options to consider.

The bundled approach proves effective because most hoteliers and managers aren’t necessarily seeking best-in-class solutions for specific features. To quote several hoteliers we’ve had discussions with, “They don’t need a Ferrari; they’re happy with a Fiat” (you can probably guess the country of origin). This concept becomes particularly compelling in the numerous cases, where establishments can achieve cost savings by replacing 3-4 separate tools with a single unified platform. Additionally, it simplifies the complexity associated with using these tools, which is especially valuable today due to the exacerbation of high staff turnover caused by labor shortages in the hospitality industry. In this scenario, bundling makes it more cost-effective and convenient for customers while enhancing unit economics. Furthermore, once implemented, PMS systems are notably challenging to replace as they govern the core operations of these establishments.

On the flip side, convincing managers to replace the PMS that they have relied on for a long time, which plays a crucial role in their daily operations, is not an easy task. The approach that other companies, similarly to SiteMinder, have taken is to first tackle a specific feature that is particularly underserved to get their foot in the door and then upsell new features once they have built a relationship with their customers. SiteMinder built one of the first channel managers in 2006 and until 2015 remained solely focused on growing their customer base. In 2015, only after achieving significant scale, they expanded their set of solutions by acquiring an online booking engine and launching their website-building tool. Since then, they have consistently introduced new features.

Much like the growth of SiteMinder’s platform was fueled by the rise of OTAs, we see opportunities arising from shifting customer behaviors and recent advancements in artificial intelligence. Some of these opportunities lie in developing solutions that effectively address longstanding pain points that incumbents have struggled to solve economically for the long tail. Illustrative examples include service automation solutions like Duve, Hotel Manager and, Shackle, as well as second-generation revenue management solutions such as Room Price Genius and Smart Pricing. Adding capabilities that build on these developments will be crucial for all companies in the long run, including bundled solutions.

However, the problem with not having control over the core system is that, while these solutions may experience faster initial growth due to reduced setup difficulties, building a robust defense against competitors becomes more difficult. For the long tail specifically, there is a limit to how much you can continue to upsell (in terms of SaaS fees), so customer retention is crucial. SiteMinder seems to have started to address this challenge by introducing Little Hotelier an all-in-one solution that they market separately from their core brand to the long tail.

While we’ve witnessed remarkable initial success from a few specialized solutions that are experiencing rapid growth targeting the long tail, we anticipate that, over time, they will have to follow one of several trajectories. They could potentially be acquired by larger platforms seeking to quickly integrate these services, opt to develop their own PMS to improve customer retention like SiteMinder has done for this segment of the market, or enhance their product offerings to cater to larger hotels with more substantial budgets who can afford to pay up for the Ferraris and ditch the Fiats.

Second-generation PMS systems for mid and large hotels are also in a strong position to seize market share from incumbents

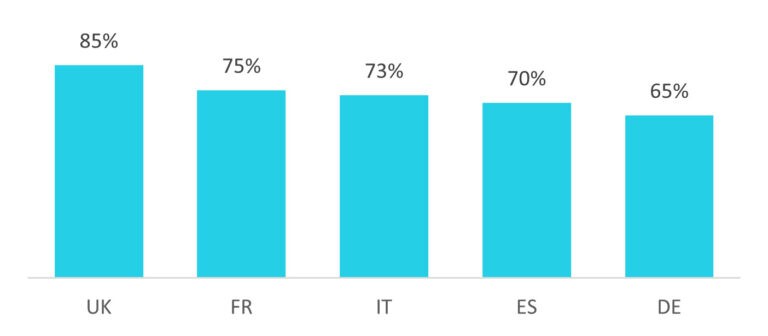

In the late 1970s, PMS made its debut in the hotel industry, gradually gaining prominence throughout the 1980s and 1990s. In recent years, they stand as the most prevalent software tool employed by hotels, with adoption rates ranging from 65% to 85% in the five largest European markets (Figure 4).

Figure 4 – Estimated PMS penetration by country (2018)

Source: Grant Thornton.

Yet, mirroring other parts of the hotel tech landscape, the progression of PMS systems since their inception has been notably sluggish. Even in the mid to large segment of the market, many PMS systems remain outdated, inflexible, and reliant on intricate and costly integrations.

This stagnation can be traced back to the dominance of legacy PMS providers like Oracle Hospitality and Protel (now rebranded as Planet), who have been hesitant to embrace innovation and integrations. Part of the reason for their reluctance has been that older, well-established properties with complex and feature-rich legacy PMS systems, find the process of migrating to the cloud time-consuming and disruptive, and they have preferred to delay it whenever possible. In 2018, the average proportion of PMS systems operating in the cloud among the top five European countries stood at 17%, whereas the estimated average for enterprises purchasing cloud computing services in these countries was approximately 25%.

Unlike smaller hotels, larger establishments do have the budget and appetite for customized and flexible solutions. However, until recently, these legacy PMS systems also operated as closed systems, making it challenging for hotels to integrate third-party solutions into their PMS.

Case study: Companies like Mews and Apaleo are actively working to disrupt this cycle

Mews was the first company to launch a cloud-based open PMS system in 2012. Initially, the founders set out to develop a solution that would empower hotels to offer personalized guest experiences. However, they redirected their efforts toward creating an open PMS system upon realizing how challenging it would have been to integrate their solution with existing PMS providers at the time. Today, Mews seamlessly integrates with 750+ third-party applications through its marketplace. The company serves over 3.2k clients as of 2023 which on average take advantage of eight integrations.

In line with the dynamic that we were describing for the long tail of establishments, the COVID-19 pandemic has underscored the need for hospitality providers to adopt flexible systems that can be adapted quickly to meet evolving guest expectations. Labor shortages and the ongoing turnover of staff have also made it difficult for large hotels to hire and train workers capable of handling complex PMS systems.

It’s anticipated that over 50% of hotels will have either upgraded or acquired a new PMS between 2022 and 2024. In this transition, we see cloud-first open PMS platforms as highly competitive players that are well-positioned to expand their market share.

An interesting aspect of all second-gen solutions is that many of them have introduced their own payment capabilities. This opens a substantial opportunity for increased monetization, particularly for the companies targeting medium and large hotels. Mews serves as a prime example, generating over 50% of its revenues from payments.

A final consideration is that all-in-one platforms for the long tail also provide user-friendly, integrated, and cloud-based solutions. As they saturate their initial customer base and look to expand, they may be enticed to enter the upmarket segment. Mews started targeting smaller hotels and has since moved upmarket. Cloudbeds also launched its marketplace in 2019 and has consistently invested resources to enhance its product. It will be interesting to see if other platforms adopt similar strategies in the long term. Talent often transitions from SMBs to large hotels, providing potential opportunities for long tail software vendors to access larger establishments. Nonetheless, the complexity of operations increases with size and number of locations, so the preference might shift towards providing additional services that can be monetized by taking a cut of transactions, such as distribution or procurement propositions.

Conclusions

At Burda Principal Investments we provide long-term capital to fast-growing technology companies. Travel is one of the top five largest industries in the world, and we believe that in today’s post-pandemic world, it will be critical for hoteliers and property managers of alternative lodgings to adopt technology to remain competitive. Two of the sub-segments that we are particularly excited about are all-in-one solutions targeting the long tail, and second-generation cloud-based open PMS systems for mid and large hotels.

We hope you found this article interesting. If you’d like to discuss our ideas or introduce your company, please feel free to contact us at investments@burda.com or reach out directly to alejandra.oteroarenzana@burda.com. We are always eager to hear about new perspectives and ideas.