UK consumer surveys: what makes us all tick?

How has the pandemic affected the role of health in our lifestyles? What role do apps play in satisfying our fitness needs? We explore these and other Health-related topics in our recent BPI Consumer survey, which surveyed over 2,000 people living in the UK (as nationally representative sample) about their habits & preferences.

Health

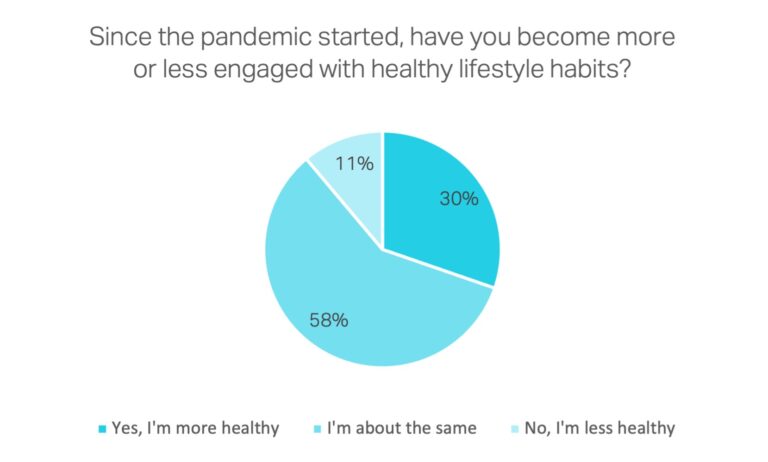

Normally, the start of the year is a time for setting ambitions for the months ahead, which for many of us includes establishing new goals for our health and fitness lifestyle. Whether it’s signing up to a new gym membership, focusing on eating more nutritious foods, or cutting back on unhealthy habits, we attempt to leave behind any bad habits that we’ve let creep in during the previous year. And by this time of a year, many of us have already given up again. However, our survey tells us that the UK population has already been transitioning towards a healthier and sustainable lifestyle during the second half of 2021. About one in three of our UK sample claims to be more healthy and more engaged with healthy lifestyle habits now, as compared to pre-pandemic.

With the pandemic reminding us of how important it is to look after our own wellbeing, many people feel driven and empowered to discover more ways to be healthy. This article explores some of the key trends we have spotted as to how this has been the case. You are more likely to be in the “healthier” group if: you are under 35, if you live in London or another big city, if your household is larger (couples and families) and if you are in higher income categories. We would like to see this status quo being 2challenged over the next few years, with more health start-ups focusing on the underserved segments that do not feel like they’ve benefitted from improved health in the last two years.

1. We are seeing healthy lifestyle changes across multiple domains since the pandemic

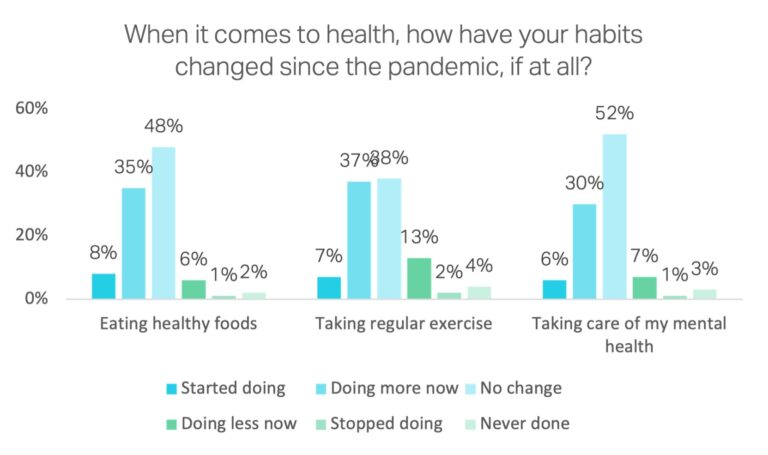

Since the pandemic, 43% of our sample reported that they are eating more healthily, 44% are taking more regular exercise, and 36% are taking better care of their mental health.

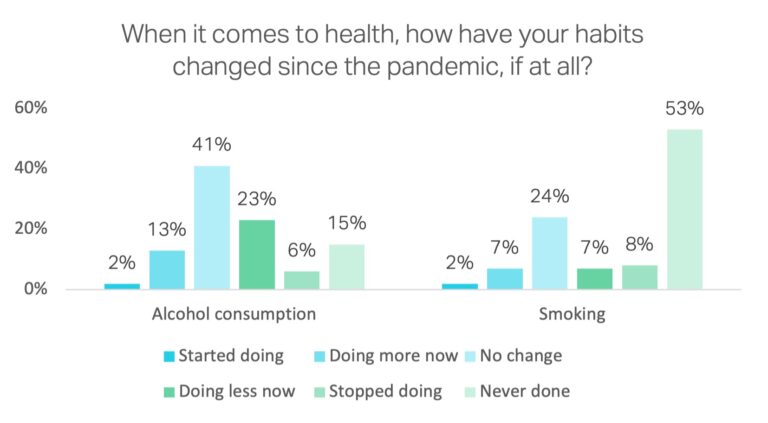

A significant portion of the UK population also appear to have cut down on unhealthy habits with 23% of people drinking less alcohol now and 15% either cutting down on smoking or cutting it out altogether since the start of the pandemic.

Given the challenges faced by the NHS, we think that this is good news and hope this is sustained. Below are some of the specific activities that people feel have positively impacted their health during and after the pandemic:

🏋 Buying exercise equipment during the pandemic to use at home

😴 Sleeping better and keeping a more consistent sleep routine

🌳 Moving out to the countryside and spending more time outside getting fresh air

🐕 Buying a pet has led people to build more walking into their schedules

2. Strong mobile app penetration for a wide range of health & fitness activities

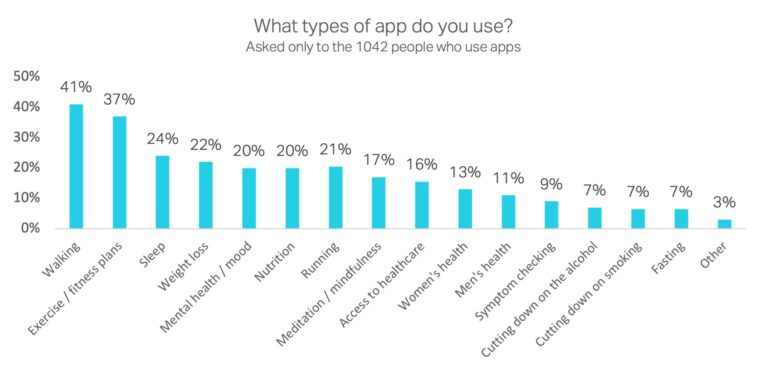

Over 50% of us use smartphone apps to help us stick to our healthy habits. This number is as high as 70% for under 35s. The opportunity for entrepreneurs and other players in the healthcare system to digitally engage consumers and patients in looking after their own health and wellbeing is already significant and will likely continue to grow over time as these younger generations mature. Amongst people who do use their smartphone, the type of applications used is very broad. The most popular apps are walking, exercise and sleep. Weight loss and nutrition, meditation and mental health, and healthcare access (e.g. NHS, Patient 4Access, Babylon Health, Livi) are also used by about a fifth of the UK population who use health apps.

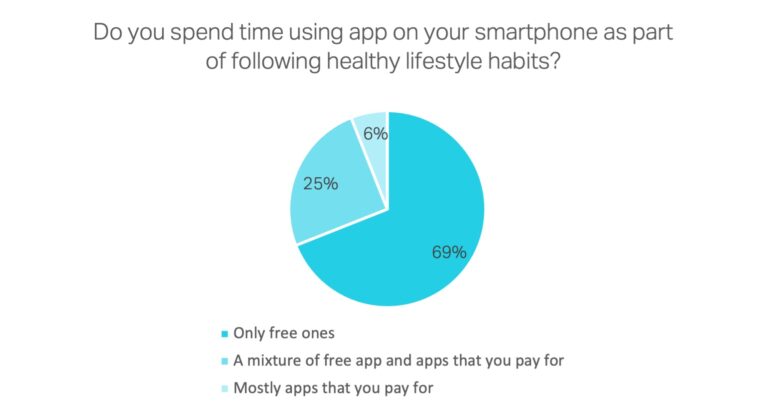

3. However, only 30% of people who use health apps are willing to pay for them

Despite the popularity of health apps, only just over 30% of users would be willing to sign up to and use an app that you must pay for. The biggest predictors for willingness to pay are age (under 35s are almost infinitely more likely to pay for apps; with 6% willing to do so compared with 0.2% of over 55s) and gender (men are twice as likely to pay for apps; with 4% willing to do so compared with 2% of women).

Conclusions

Whilst consumers and patients are getting to grips with using digital resources and smartphones to help them keep track of their own health and wellbeing, it is also apparent that monetisation of these solutions may be more challenging in terms of a direct-to-consumer approach. This may be the case more so in the UK compared with other markets, given the role of the NHS in our healthcare system. However, we believe that entrepreneurs in this space can and will continue to build great products that drive adoption and engagement and deliver brilliant outcomes to individuals and society. We also expect to continue to see strong collaboration from multiple players in the healthcare ecosystem in terms of optimising the economic equation relating to these solutions to incentivise further innovation in this space.

We look forward to watching, experiencing, and supporting the next generation of founders in the health space and their companies scaling up over the coming years in the UK and Europe. If you would like to discuss any of the results of our survey, have a chat about the future of health, or introduce your company then please reach out to us (investments@burda.com)!