BurdaPrincipal Investments (BPI), the growth capital arm of media and tech company Hubert Burda Media, has invested in leading card-free “Buy Now Pay Later” platform in the Philippines, BillEase.

Young fintech company BillEase from the Philippines has closed a major financing round with USD 11 million in fresh equity. BurdaPrincipal Investments (BPI), the growth capital arm of media and tech company Hubert Burda Media, led the Series B round. Other investors in the round include Centauri, a joint investment vehicle of Telkom Indonesia’s MDI Ventures and KB Investment and backer of Kredivo, KB Financial Group from Korea, 33 Capital from Singapore, and Tamaz Georgadze, CEO and Co-Founder of European fintech unicorn Raisin.com.

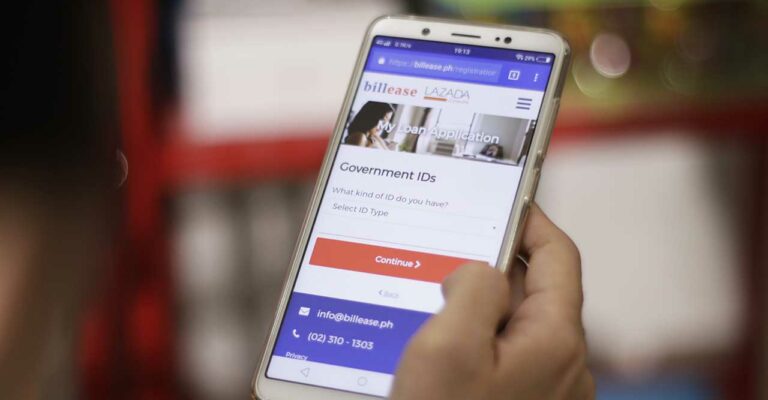

BillEase is the leading card-free “Buy Now Pay Later” platform in the Philippines. It gives customers a credit limit they can use at any of BillEase’s merchant partners. What makes the platform special is that users do not need to have a credit or debit card, and they do not have to top up to purchase – BillEase is the alternative e-wallet. Since less than five percent of the adult population in the Philippines owns a credit card, the BillEase service is proving very popular: consumers can easily register via app and apply for a loan. They can then make purchases from over 500 partners, including airlines, fashion brands, and flower delivery services. Payback options for personal loans vary from 30 days up to twelve months, and the amount can be paid through online transfer, for example. Online retailers benefit from being able to offer an installment payment option with BillEase, which helps them increase their conversion rates and average order values.

The Philippines as an emerging e-commerce market

by Katharina Richter

Senior PR Manager, Hubert Burda Media

katharina.richter@burda.com